This is the amount of sales that the company or department can lose before it starts losing money. It’s called the safety margin because it’s kind of like a buffer. You can think of it like the amount of sales a company can afford to lose before it stops being profitable. In other words, this is the revenue earned after the company or department pays all of its fixed and variable costs associated with producing the goods or services. The data was missing and the management need help from you as a consultant to determine the exact litres produced if the organization had reached breakeven point.The margin of safety is a financial ratio that measures the amount of sales that exceed the break-even point. In the month of June, the organization produced some units of juice in litres. The cost per unit data for the month of June 2020 was as follows įixed cost for the month of June was $72,000 ltd is a producer of medicinal juice for Covid-19 supplement purposes. This question can be answered by using an example įTZ co. If breakeven point model represents zero profit scenario, is it possible as an entrepreneur to set the right level of production so as to realize a specific profitability level. Setting of specific production level (units) to realize specific profitability level In conclusion, the breakeven point model is associated with marginal costing technique Suppose the entrepreneur desires no profits at all, then it means that profits=0ĭivide Contribution on both sides of the equationīreakeven Point Model-Mathematical Approach

#Break even point formula in cost accounting plus

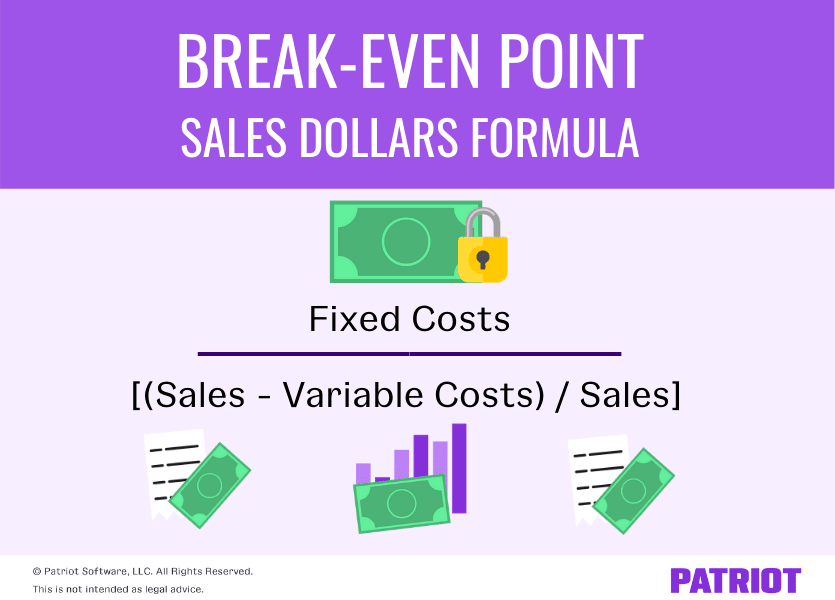

Logically, Total Revenue (TR) or sales is the total cost incurred in producing a good PLUS the desired profit. Profit is the net of contribution where by fixed cost is netted from gross contribution as Marginal cost=Direct Materials +Direct Labour +Direct Expenses +Variable Overheads The relationship between breakeven point model and marginal costing can be demonstrated using step by step procedure as follows Ĭontribution can be expressed as follows Sales is the product of selling price and the quantity sold within a particular period of timeĬontribution is the difference between sales value and variable cost NB: In marginal costing, the fixed cost is written off against the contribution value

When production level is at zero level, the fixed cost already is at a particular level. This implies that at zero level of production, variable cost is also zero.įixed cost is cost which is constant within a particular level of output or production.

As production level change, the level of variable cost also change. Variable cost is also referred to as marginal cost or relevant cost and it is the cost that varies with variance to the level of output. Marginal costing is a technique of presenting cost information to the management in a manner such that the variable and fixed cost are separated when determining the net profit of the firm or a department. Correlation between breakeven point mathematical model and marginal costingīefore we demonstrate the association between the breakeven point model and marginal costing, the following definitions are paramount If breakeven point model represents zero profit scenario, is it possible as an entrepreneur to set the right level of production so as to realize a specific profitability level.How can this model be presented mathematically.Is it possible to compute the activity level that represents breakeven point scenario using mathematical approach?.Is there any correlation between breakeven point mathematical model and marginal costing?.Three questions arise from this mathematical model It is that level of activity or operation whereby the total revenue is equal to total cost (ie TR=TC).

Breakeven point analysis-mathematical approachīreakeven point analysis is a mathematical model.

0 kommentar(er)

0 kommentar(er)